Economic Quarterly Report .

Q1 2024

If you want to download the full report scroll to the bottom and click on Download Report.

Our Economic Market Update looks at the key areas weighing on the property market in the previous quarter and provides some insight in how we expect things to play out in the future.

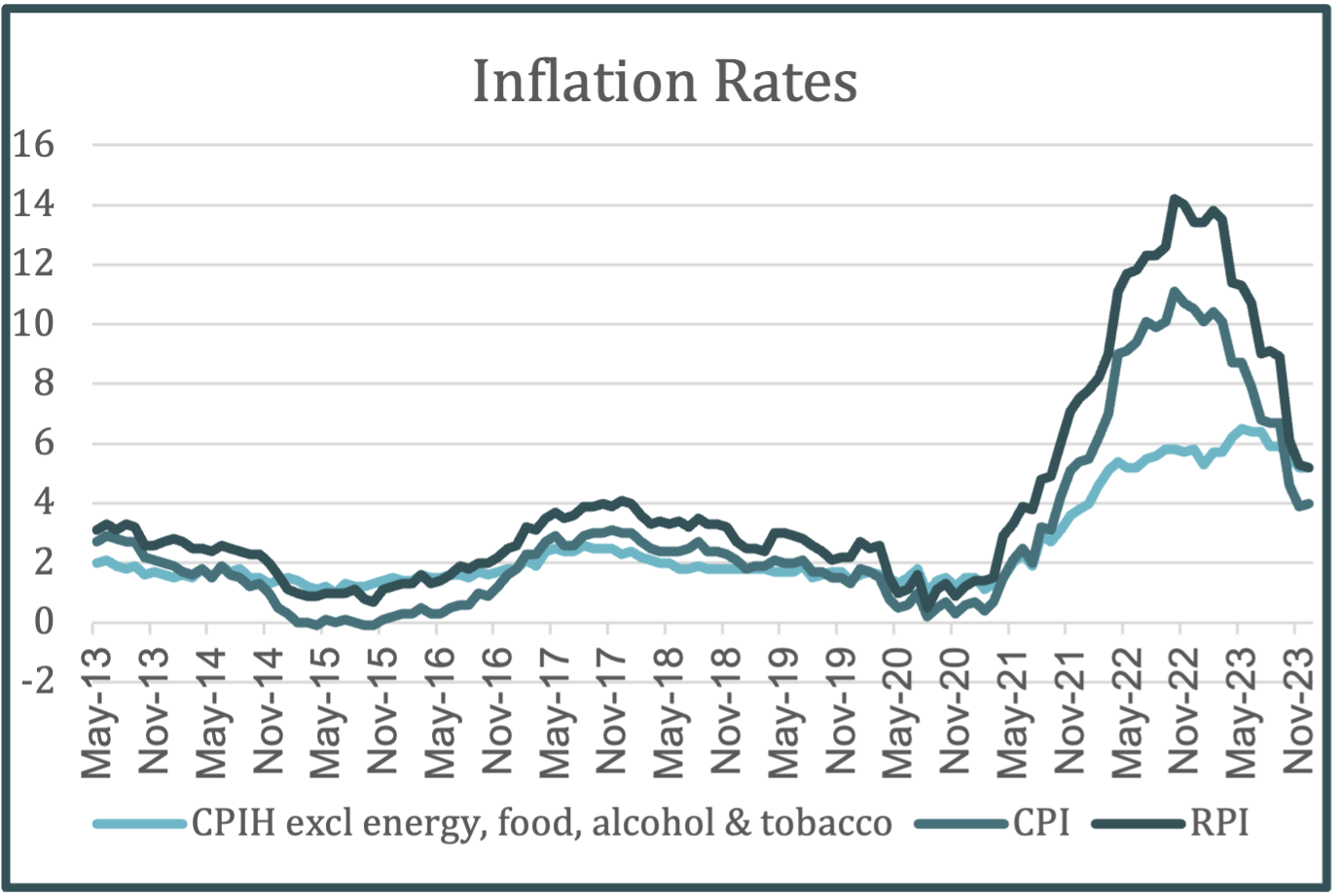

High and stubborn core inflation still rising.

Interest rates rises, likely to continue until the end of the year.

Potential recession in data terms, but soft landing seems plausible.

UK housing prices are down this year as high interest rates affect purchasers, although prices have recently begun to rebound.

Cost of material and supply and labour shortages are coming down but continue to hamper development.

Continued occupational demand for space especially in industrial, with a flight to quality and efficiency in offices.

Pricing disparities between vendors and purchasers.

There continues to be a weight of money waiting in the background for signs of stability, as interest rates begin to fall we expect significantly more transactions to emerge admist a continued subdued market.

CPI and RPI, are falling from their October peak, but continued strength in core inflation means there’s further reduction required to meet the BoE’s 2% target rate.

2024 is likely to continue to be a low transaction environment but check out our Economy Quarterly Report for further information.